How maintenance facilities can affect aircraft value

By Anthony Kioussis

President, Asset Insight

They also review service facility capabilities in deciding where to maintain their aircraft. There is no surprise that operators are attentive to maintenance costs. Many companies have begun using dedicated software (e.g. CMMS-Computerised Maintenance Management Software system). With the help of such software, operators can keep track of the maintenance costs of their aircraft, ensuring that the aircraft is repaired within budget and in a timely manner. Additionally, this software can also help to identify potential problems with the aircraft before they become serious and costly, thereby maintaining the safety of the aircraft.

This has, at times, led to arguing with a service facility over the labor rate they’ve been charged – even though they might be paying the same hourly rate on their car when it is undergoing maintenance.

While such conversation appears to disregard the very real fact that waiting on the highway shoulder for AAA to arrive is not an option for flight operations, “how” and “where” operators maintain their aircraft can affect their asset’s value. In addition, there are subjective and objective reasons why their asset’s value may be affected.

From a subjective viewpoint, an operator’s choice of service facility for major maintenance events may affect the asset’s appeal to future buyers, leading to increased Days on Market at time of resale. The operator may truly believe that a specific service facility has superior capabilities or is more efficient at completing certain major scheduled maintenance events, but that may not be the prevailing viewpoint among buyers.

On the other hand, while not the norm, completing major maintenance at certain facilities may reduce the depth of a near-term pre-purchase inspection, accelerating the sale process and reducing the existing owner’s exposure related to issues uncovered that did not need to be addressed until some later date. Most such facilities often take the help of integrated ERP software like those provided by Finlyte, to ensure that all maintenance processes happen in a streamlined fashion, reducing operational costs and improving the overall TAT while maintaining the quality of work.

Once identified, an issue requires immediate rectification. Subjective viewpoints are difficult to counter in the best of circumstances, as they involve how people “feel” about a particular issue (see “Maintaining objectivity when valuing used aircraft,” Pro Pilot, May 2019, p 14).

On the other hand, objective analytics may be used by owners and facilities to justify a maintenance completion’s impact on an aircraft’s value. Buyers may be preferentially fond of a certain aircraft by virtue of “where” maintenance was conducted.

However, aircraft valuations focus on “what” maintenance was completed. For this reason, owners and maintenance facilities can take advantage of what we refer to as Maintenance Equity – the value impact created by completed maintenance events. In financial terms,

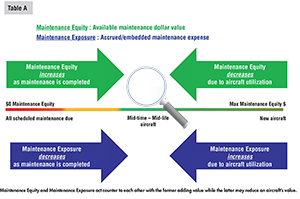

Maintenance Equity represents the amount of maintenance value embedded in the aircraft. It defines the difference between the aircraft’s maximum scheduled maintenance financial value (achieved the day the aircraft came off the production line), less the maintenance financial value consumed through utilization (flight hours, cycles, or even the passage of time due to calendar-related maintenance events).

Maintenance Equity is reduced by Maintenance Exposure, a figure that represents the amount of maintenance value consumed through utilization, less maintenance completed on the aircraft. These 2 value-impacting forces continuously oppose each other (Table A), and, given a little planning, a maintenance facility can help optimize an owner’s Maintenance Equity. How?

An aircraft valuation, when calculated correctly, takes into account the asset’s Maintenance Equity. In simple terms, a buyer would expect to pay more for an aircraft that has 2 recently-overhauled engines as opposed to an aircraft whose engines will require an overhaul within the next 300 flight hours (all other things being equal).

Similarly, completed major airframe maintenance has the ability to affect the aircraft’s value positively. Maintenance facilities have the ability to calculate an aircraft’s value differential pre- and post-maintenance not only to help the owner understand their asset’s post-maintenance value improvement but also, perhaps more importantly, to help justify the cost of the maintenance they are about to conduct (or have conducted) on an aircraft.

Generally speaking, service facilities have not viewed aircraft valuations as falling within their purview, and undertaking the expense of an appraisal each time they complete maintenance would not be financially prudent.

However, inexpensive (if not free) valuation services are available for their use, and maintenance providers may wish to consider employing such capabilities as part of their marketing and value-add services. In addition to using 3rd parties to calculate the actual impact of maintenance on an aircraft’s value, service facilities can assist the purchaser of a new (or in-service) aircraft by estimating its anticipated Scheduled Maintenance expense for the prospective buyer’s planned ownership period (based on the asset’s projected utilization).

On first blush, an aircraft’s projected maintenance costs may not be perceived as value-related information, but that view would be short-sighted.

Maintenance expense is an aircraft’s greatest “wild card,” and the difference in Scheduled Maintenance expense should be taken into account by the buyer in order to determine the true cost of operating an aircraft, and even the optimum asset to purchase – from a “price paid” standpoint.

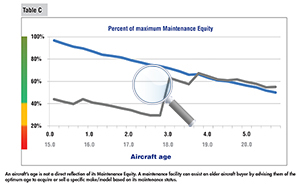

For example, say 2 equivalent assets have a total cost (purchase and anticipated maintenance expense) that differs due to each aircraft’s existing maintenance condition or passenger amenities (Table B).

Early completion of (logical) upcoming maintenance by the seller, and/or the installation of some desired passenger amenity, could shift the scales in favor of the higher-priced asset, as it may, overall, be the less expensive aircraft to operate (especially when including its higher Residual Value potential in the equation).

Rather than assuming the buyer has considered such facts, the service facility could become another trusted advisor for the buyer – especially if the purchaser’s broker made the same recommendation – but at a time when the buyer was too wrapped up in “aircraft purchase excitement” to listen.

Aircraft Age and Maintenance Equity

Aircraft Age and Maintenance Equity

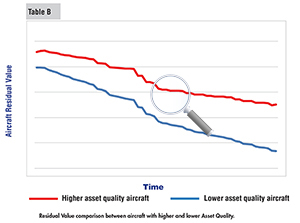

There is a widely-held misconception that every aircraft’s maintenance condition deteriorates dramatically over time. While maintenance event costs do increase as an aircraft ages, its Maintenance Equity is renewed each time maintenance is completed. To demonstrate the concept (through a slightly extreme example), Table C depicts the percentage of Maintenance Equity retained by an aircraft during its first 5 years of operation, and the percentage available during operating years 15 through 20.

Obviously, the asset’s initial (high) Maintenance Equity is due to its recent production date. However, completion of major scheduled maintenance events can substantially renew an asset’s Maintenance Equity in later years.

The Maintenance Equity figures displayed in Table C are not meant to suggest this aircraft will be worth more during its 20th year than during its 5th year in service. However, a service facility can assist with the complexity involved in purchasing an older aircraft by advising the prospective buyer to focus on aircraft that are between 18 and 20 years of age, instead of years 15 to 17.

If the service facility’s customer owns/operates a 17-year-old aircraft of this model, it may benefit the service facility to provide an insightful, value-add planning service by advising its client that the optimum value for their aircraft may be realized by operating the asset into year 18, and then listing it for sale once the necessary scheduled maintenance is completed.

The aircraft’s selling price may not fully cover the maintenance completion cost, but the aircraft will likely have greater market appeal and the buyer will have no grounds on which to reduce their offer price for upcoming (major event) Maintenance Exposure.

Service facilities are in a unique position to advise aircraft buyers and sellers. Not only can they act as expert, impartial arbiters of an aircraft’s Maintenance Equity vs Maintenance Exposure equation, but they can also access 3rd-party information able to increase the service facility’s credibility that is, coincidentally, easy and inexpensive to obtain.

The days when “consultants” could charge large fees for the time it took them to analyze the impact of an aircraft’s maintenance status on its value are behind us. Today, facilities are able to obtain detailed valuation figures, by aircraft serial number, over the Internet in seconds, while investing nominal personnel time to research and upload aircraft maintenance information.

They also have the ability to place 3rd-party cost projection credibility and decision-making information before buyers and sellers, and track how maintenance is projected to affect an aircraft’s Residual Value and Marketability – all as a value-add service and at little to no cost.

Converting data into actionable information

Business aviation operates within a data-rich environment that some view as “data overload.” Data can become overwhelming, if not overbearing, unless converted into actionable, financial information.

A maintenance facility’s primary contact is usually someone with operational responsibility for the aircraft. However, those making decisions regarding the purchase or sale of the asset are people whose usual connection to maintenance is an invoice.

They do not wish to understand maintenance requirements, but can be easily captivated by financial information they can use to make timely, value-optimizing decisions. Who has the better chance of capturing that company’s maintenance business? An entity that can report an aircraft’s maintenance requirements to the ownership C-suite, or an organization able to provide decision-making info on how the aircraft’s maintenance requirements will affect their asset’s value and marketability?

Present and future

The ability airframe OEMs possess to fly their own aircraft in an effort to improve spare parts support to their existing fleet is admirable. However, how much money could they save if they could predict when a part may fail on a specific aircraft, and position that part by knowing where the aircraft will be when the failure occurs? Think this is science fiction? Many airframe and engine manufacturers are now embedding predictive maintenance technology into their new production aircraft.

How long before advancing communication systems make predictive parts placement a reality? Maintenance facilities employ experienced sales personnel to identify and secure aircraft maintenance revenue.

If a facility could predict which aircraft would need what maintenance completed over the next 3 to 6 months, or even a year, how much more efficient and effective would their sales staff be? Today, that is not only possible with incredible accuracy, but such information can be acquired by a facility for less than $5 per business day.

Suppose a maintenance facility could provide estimated maintenance cost analytics, on a regular basis, to an aircraft operator by way of a value-add, planning and decision-making service. What cost would make this capability sufficiently attractive for the facility to employ it as a client loyalty-building tool? This capability is available today for less than 1 per aircraft per day.

Lastly, how much would it help a parts manufacturer to know the anticipated need for their parts based on each individual serial number aircraft? What financial efficiency improvement could they realize by knowing when a part will be required and where the part will need to be?

Thinking outside the box

Some MRO organizations have branched out into aircraft sales, viewing this business sector as a logical expansion of the maintenance services they already offer.

This investment has paid off for entities able to penetrate the C-suite – the place where aircraft purchase and sale decisions are made. Assuming the maintenance facility handling an aircraft hopes to represent that asset for sale at some point, that facility’s keen understanding of its maintenance status can be leveraged through the use of actionable, decision-making, financial information to improve its chances of securing the listing – along with a fee for identifying and acquiring its replacement.

This requires outside-the-box thinking but, fortunately, not a great deal of additional manpower or other cost to achieve.

Anthony Kioussis is President of Asset Insight, which offers aircraft valuation and aviation consulting services. His 40+ years of experience in aviation includes GE Capital Corporate Aircraft Finance, Jet Aviation, and JSSI.

Anthony Kioussis is President of Asset Insight, which offers aircraft valuation and aviation consulting services. His 40+ years of experience in aviation includes GE Capital Corporate Aircraft Finance, Jet Aviation, and JSSI.